1. Title Page

1.1 Intro - Page 1

2. Course Menu

2.1 Main Menu

3. Introduction

3.1 Untitled Slide

Notes:

Medicare

Fraud & Abuse: Prevent, Detect, Report - Introduction

3.2 Intro – Page 1

Notes:

The Medicare Fraud

& Abuse: Prevent, Detect, Report course is brought to you by the Medicare

Learning Network®

3.3 Intro - Page 2

Notes:

The Medicare Learning Network®

(MLN) offers free educational materials for health care professionals on

Centers for Medicare & Medicaid Services (CMS) programs, policies, and

initiatives. Get quick access to the information you need.

· MLN Publications & Multimedia

· MLN Events & Training

· MLN News & Updates

3.4 Intro - Page 3

Notes:

Navigating and Completing This

Course

This WBT has course content,

reference documents, review questions, and an assessment. Successfully

completing this course requires an assessment score of 70% or higher.

This course uses cues at various

times to give additional information. The cues are hyperlinks, buttons,

rollovers, and pop-up windows. For more information on these cues, select Help

in the top left corner. The Reference button includes

resource documents and a glossary of defined terms within it. You may print

these materials at any time.

After successfully completing the

course, you’ll get instructions on how to get

your certificate.

Visit the Reference

page for disclaimers, a list of helpful websites, and frequently asked

questions (FAQs). You may find this information useful as you go through this

course.

Watch the embedded videos or read

the transcripts. Information in the videos helps you meet course learning

objectives.

3.5 Intro - Page 4

Notes:

Welcome to the Medicare Fraud &

Abuse: Prevent, Detect, Report Course!

This course educates health care

professionals about how to prevent, detect, and report Medicare fraud &

abuse.

Although there is no precise measure

of health care fraud, those who exploit Federal health care programs can cost

taxpayers billions of dollars while putting beneficiaries’ health and

welfare at risk. The impact of these losses and risks magnifies as Medicare

continues to serve a growing number of beneficiaries.

The Federal government aggressively

cracks down on fraud & abuse, but it needs your help. All health care

professionals must do their part to prevent fraud & abuse.

Please note: The information in this

course focuses on the Medicare FFS Program (also known as Original Medicare).

Many of the laws discussed apply to all Federal health care programs (including

Medicaid and Medicare Parts C and D). See Job Aid C for information on

fraud & abuse in Medicaid and Medicare Parts C and D.

3.6 Intro - Page 5

Notes:

Do Your Part, Get Informed!

Committing Fraud Is Not Worth It

· Medicare Trust Fund

recovered approximately $1.2 billion

· $232 million

recovered in Medicaid Federal money transferred to the Treasury

· The Federal

government convicted 497 defendants of health care fraud

· Department of

Justice (DOJ) opened 1,139 new criminal health care fraud investigations

· DOJ opened 918 new

civil health care fraud investigations

Consequences

· HHS OIG Criminal

Actions:

· FY 2016: 765

· FY: 2017: 766

· FY: 2018: 679

· HHS OIG Civil

Actions:

· FY 2016: 690

· FY 2017: 818

· FY 2018: 795

· 2,712 Exclusions

NOTE: All statistics cover FY 2018

unless otherwise noted.

3.7 Intro - Page 6

Notes:

Course Objectives

After completing this course, you

should correctly:

· Identify what

Medicare considers fraud & abuse

· Identify Medicare

fraud & abuse provisions and penalties

· Recognize Medicare

fraud & abuse prevention methods

· Recognize entities

that detect Medicare fraud & abuse

· Recognize how to

report Medicare fraud & abuse

3.8 Intro - Page 7

Notes:

Course Overview

This course consists of five

lessons:

· Lesson 1: Medicare

Fraud & Abuse explains fraud & abuse basics

· Lesson 2: Medicare

Fraud & Abuse Laws and Penalties outlines the laws and sanctions used to

fight fraud & abuse

· Lesson 3: Physician

Relationships with Payers, Other Providers, and Vendors describes methods to

prevent Medicare fraud & abuse

· Lesson 4: Medicare

Anti-Fraud and Abuse Partnerships and Agencies identifies the entities charged

with detecting Medicare fraud & abuse

· Lesson 5: Report

Suspected Medicare Fraud & Abuse describes how to report suspected Medicare

fraud & abuse, how to self-disclose violations, and the rewards available

for reporting fraud & abuse

Select the Continue Arrow to return

to the Course Menu. Then, select Lesson 1: Medicare Fraud & Abuse.

4. Lesson 1

4.1 Title Card

Notes:

Medicare Fraud & Abuse: Prevent,

Detect, Report

Lesson 1: Medicare Fraud & Abuse

4.2 Lesson 1: Medicare Fraud & Abuse

Notes:

Lesson 1: Medicare Fraud & Abuse

This lesson introduces the basic

Medicare fraud & abuse concepts and what you must know to detect it within

your organization. Fraud is a crime with serious consequences, including

exclusion from Federal health care programs, fines, and prison. It should take

about 10 minutes to complete this lesson.

In this lesson, you’ll

learn about:

· Medicare fraud

· Medicare abuse

This lesson includes Medicare fraud

& abuse examples.

In 2018, the Federal government won

or negotiated over $2.3 billion in health care fraud judgments and settlements.

4.3 Lesson 1: Learning Objectives

Notes:

Lesson 1: Learning Objectives

After completing this lesson, you

should correctly:

· Identify Medicare

fraud basics

· Identify Medicare

abuse basics

· Recognize Medicare

fraud & abuse instances

4.4 Medicare Fraud & Abuse: A Serious Problem Requiring Your Attention

Notes:

Medicare Fraud & Abuse: A Serious Problem Requiring Your

Attention

Health care fraud can cost taxpayers

billions of dollars. The dollars lost to Medicare fraud & abuse increase

the strain on the Medicare Trust Fund. The impact of these losses and risks

magnifies as Medicare continues to serve a growing number of people.

Schemes and fraudulent billing

practices not only cost taxpayers, they endanger the

health and welfare of beneficiaries. For example, dozens of patients got

medically unnecessary cardiac pacemakers implanted because of a

cardiologist-involved scam. The doctor convinced his patients to get the

pacemakers by telling them they would die, even though they had a non-fatal

diagnosis. Thanks to anti-fraud efforts and education, law enforcement caught

and prosecuted the doctor. He was sentenced to 42 months in prison and ordered

to pay over $300,000 in fines and restitution.

4.5 Medicare Fraud & Abuse: A Serious Problem Requiring Your Attention (cont.)

Notes:

Medicare Fraud & Abuse: A Serious Problem Requiring Your

Attention (cont.)

To combat fraud & abuse, you

must know how to protect your organization from potential abusive practices,

civil liability, and possible criminal activity. You play a vital role in

protecting the integrity of the Medicare Program.

4.6 What Is Medicare Fraud?

Notes:

What Is Medicare Fraud?

· Knowingly

submitting, or causing to be submitted, false claims, or making

misrepresentations of facts to obtain a Federal health care payment (in other

words, fraud includes obtaining something of value through misrepresentation or

concealment of material facts)

· Knowingly

soliciting, receiving, offering, and/or paying remuneration to induce or reward

referrals for items or services reimbursed by Federal health care programs

· Making prohibited

referrals for certain designated health services

4.7 Examples of Medicare Fraud

Notes:

Examples of Medicare Fraud

Examples of actions that may

constitute Medicare fraud include:

· Knowingly billing

services not given or supplies not provided, including billing Medicare

appointments patients fail to keep

· Knowingly altering

claim forms, medical records, or receipts to get a higher payment

· Paying for

referrals of Federal health care program beneficiaries

To learn about real cases of

Medicare fraud and its consequences, see the case studies in Job Aid A.

4.8 Fraud in Practice

Notes:

Fraud in Practice

Anyone can commit Medicare fraud,

including people you know. Move the slider below to explore examples of Fraud

cases.

Medicare fraud extends beyond

medical professionals. Corporations and organized crime networks commit

Medicare fraud, unlawfully getting millions of Medicare Program dollars.

A major pharmaceutical manufacturer

pled guilty to misbranding and paid $600 million to resolve criminal and civil

liability from promoting a certain drug. Part of the settlement resolved

allegations the company misled doctors about the drug’s safety and

success and instructed them to miscode claims to ensure Federal health care

payments. The company also allegedly paid doctors kickbacks.

In another case, the government

charged 73 defendants when investigators uncovered an organized crime

ring’s scheme that allegedly involved more than $163 million in

fraudulent billings and identity theft impacting thousands of beneficiaries and

doctors.

Fraud Example 1

A hospital paid $8 million to settle

allegations it knowingly kept patients hospitalized, beyond the time considered

medically necessary, to increase its Medicare payments and maintain its

classification as a long-term acute care facility.

Fraud Example 2

A Durable Medical Equipment (DME)

business owner served 70 months in prison and paid $1.9 million in restitution

after pleading guilty to conspiracy to commit health care fraud and aggravated

identity theft. The DME company owner created several

different companies and submitted more than 1,500 false and fraudulent claims

to Medicare for unnecessary medical equipment.

Fraud Example 3

An oncologist and his wife paid $3.1

million to resolve allegations they jointly defrauded Medicare and other

Federal health care programs by overbilling medications and services and

billing medications and services not provided.

Fraud Example 4

A court sentenced a home health

provider to 168 months in prison for his role as one of the owners of a home

health agency that submitted about $45 million in false claims to Medicare.

Almost all his insulin claims billed twice-daily injections to purportedly

homebound diabetic patients. The investigation revealed most patients were not

homebound or insulin-dependent diabetics.

4.9 What is Medicare Abuse?

Notes:

What is Medicare Abuse?

Abuse describes practices that,

either directly or indirectly, result in unnecessary costs to the Medicare

Program. Abuse includes any practice inconsistent with providing patients

medically necessary services, meeting professionally recognized standards, and

charging fair prices.

Both fraud & abuse can expose

providers to criminal, civil, and administrative liabilities.

4.10 Examples of Abuse

Notes:

Examples of Abuse

Examples of actions that may

constitute Medicare abuse include:

· Billing unnecessary

medical services

· Charging excessively

for services or supplies

· Misusing claim

codes, such as upcoding or unbundling codes

To learn about real Medicare abuse

cases and its consequences, see the case studies in Job Aid B.

4.11 Program Integrity

Notes:

Program Integrity

Program Integrity includes a range

of activities to target the various causes of improper payments beyond fraud

& abuse. Select the vulnerability on the left to see the severity of the

consequences.

· Mistakes result in errors:

such as incorrect coding

· Inefficiencies result in waste:

such as ordering excessive diagnostic tests

· Bending the rules results in abuse:

such as improper billing practices (like upcoding)

· Intentional

deceptions

result in fraud, such as billing for services or supplies that were not provided

NOTE: The types of improper payments

are examples for educational purposes. Providers who engage in these practices

may be subject to administrative, civil, or criminal liability.

4.12 Lesson 1: Summary

Notes:

Lesson 1: Summary

· Fraud & abuse

drain billions of dollars from the Medicare Program each year and put

beneficiaries’ health and welfare at risk by exposing them to unnecessary

services, taking money away from care, and increasing costs.

· Fraud & abuse

jeopardize quality health care and services and threaten the integrity of the

Medicare Program by fostering the misconception that Medicare means easy money.

· Fraud & abuse

cost you as a health care provider and taxpayer. Fraud & abuse result in

waste and unintentionally financing criminal activities.

· Fraud includes, but

is not limited to, knowingly submitting false statements or making

misrepresentations of material facts to get a Federal

health care payment for which no entitlement would otherwise exist.

· Abuse describes

practices that, either directly or indirectly, result in unnecessary Medicare

Program costs.

4.13 Lesson 1 Review Title Card

Notes:

Review Questions

Lesson 1: Medicare Fraud & Abuse

After selecting an answer for a

question, select Submit Answer for feedback on the correct answer.

4.14 Review Question 1

Notes:

Review Question 1

Select the correct answer.

If you knowingly submit a false

statement of material fact to get a Medicare payment when no entitlement would

otherwise exist for someone other than yourself, you did not commit Medicare fraud.

· True

· False

4.15 Review Question 2

Notes:

Review Question 2

Select the correct answer.

Medicare abuse describes practices

that directly or indirectly result in unnecessary Medicare Program costs.

· True

· False

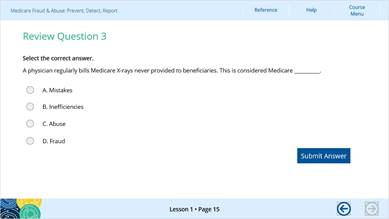

4.16 Review Question 3

Notes:

Review Question 3

Select the correct answer.

A physician regularly bills Medicare

X-rays never provided to beneficiaries. This is considered Medicare __________.

· Mistakes

· Inefficiencies

· Abuse

· Fraud

4.17 You’ve completed Lesson 1: Medicare Fraud & Abuse

Notes:

You’ve completed Lesson

1: Medicare Fraud & Abuse

Now that you’ve

learned about Medicare fraud & abuse, let’s look at relevant Medicare

fraud & abuse laws. Lesson 2 explains provisions and penalties used to

fight and punish fraud & abuse and preserve Medicare Program integrity.

Select the Continue Arrow to return

to the Course Menu. Then, select Lesson 2: Medicare Fraud & Abuse Laws and

Penalties.

5. Lesson 2

5.1 Untitled Slide

Notes:

Medicare Fraud & Abuse: Prevent,

Detect, Report

Lesson 2: Medicare Fraud & Abuse

Laws and Penalties

5.2 Lesson 2: Medicare Fraud & Abuse Laws and Penalties

Notes:

Lesson 2: Medicare Fraud & Abuse

Laws and Penalties

In this lesson, you’ll

learn about laws the Centers for Medicare & Medicaid Services (CMS) and its

partners use to address fraud & abuse. Knowledge of fraud & abuse laws

helps you partner in preventing these activities, which drains billions of

dollars from the Medicare Program, endangers its integrity, drives up health

care costs, and compromises beneficiary health care services. This lesson should

take you about 35 minutes to complete.

In this lesson, you’ll

learn about:

· Federal laws

governing fraud & abuse

· Penalties for fraud

& abuse

5.3 Lesson 2: Learning Objectives

Notes:

Lesson 2: Learning Objectives

After completing this lesson, you

should correctly

· Identify these

fraud & abuse Federal laws:

· Federal Civil False

Claims Act (FCA)

· Anti-Kickback

Statute (AKS)

· Physician

Self-Referral Law (Stark Law)

· Criminal Health

Care Fraud Statute

· Exclusion Statute

· Civil Monetary

Penalties Law (CMPL)

· Recognize civil and

criminal fraud penalties

Use

Job Aid F as a resource for the laws discussed in

this lesson.

5.4 Medicare Fraud & Abuse Laws

Notes:

Medicare Fraud & Abuse Laws

The FCA, AKS, Physician

Self-Referral Law (Stark Law), Criminal Health Care Fraud Statue, Social

Security Act, which includes the Exclusion Statute, and CMPL, are the main laws

that address Medicare fraud & abuse and specify the criminal, civil, and

administrative penalties the government imposes on those committing fraud &

abuse. Violations may result in:

· Medicare-paid

claims recoupment

· Civil Monetary

Penalties (CMPs)

· Exclusion from

Federal health care programs participation

· Criminal and civil

liability

These

laws prohibit Medicare Part C and Part D and Medicaid fraud & abuse.

Let’s take a closer look at Medicare fraud &

abuse laws.

5.5 False Claims Act

Notes:

False Claims Act

The FCA (31 United States Code [U.S.C.] Sections 3729-3733) protects the

Federal government from being overcharged or sold substandard goods or

services. The FCA imposes civil liability on any person who knowingly submits,

or causes the submission of, a false or fraudulent claim to the Federal

government. The terms “knowing” and “knowingly” mean a

person has actual knowledge of the information or acts in deliberate ignorance

or reckless disregard of the truth or falsity of the information related to the

claim.

There is also a criminal FCA (18 U.S.C. Section 287). Criminal penalties for submitting false

claims may include prison, fines, or both.

Example: A physician

knowingly submits claims to Medicare for medical services not provided or for a

higher level of medical services than provided.

5.6 Anti-Kickback Statute

Notes:

Anti-Kickback Statute

The AKS (42 U.S.C. Section 1320a-7b(b)) makes it a crime to knowingly and

willfully offer, pay, solicit, or receive any remuneration directly or

indirectly to induce or reward referrals of items or services reimbursable by a

Federal health care program. Remuneration includes anything of value such as

cash, free rent, expensive hotel stays and meals, and excessive compensation

for medical directorships or consultations.

Criminal penalties and

administrative sanctions for violating the AKS may include fines, imprisonment,

and exclusion from participating in Federal health care programs.

The Code of Federal Regulations

(CFR) at 42 CFR Section 1001.952 sets the safe

harbor regulations and describes various payments and business practices that

may satisfy regulatory requirements and may not violate AKS. Go to the Safe Harbor Regulations webpage for more information.

Example: A provider gets

cash or below-fair-market-value rent for medical office space in exchange for

referrals.

5.7 Physician Self-Referral Law (Stark Law)

Notes:

Physician Self-Referral Law (Stark

Law)

The Physician Self-Referral Law

(Stark Law (42 U.S.C. Section 1395nn) prohibits a

physician from referring certain “designated health services” (for

example, clinical laboratory services, physical therapy, and home health services),

payable by Medicare or Medicaid, to an entity where the physician (or an

immediate family member) has an ownership/investment interest or has a

compensation arrangement, unless an exception applies.

Penalties for physicians who violate

the Stark Law include fines, repayment of claims, and potential exclusion from

participation in Federal health care programs.

Review the Code List for Certain Designated Health Services (DHS) webpage and

request an advisory opinion if you have questions on specific

scenarios.

Review the Comparison of the Anti-Kickback Statute and Stark Law for a simplified

overview of the two laws.

Example: A provider refers

a patient for a designated health service to a clinic where the physician (or

an immediate family member) has an investment interest.

5.8 Criminal Health Care Fraud Statute

Notes:

Criminal Health Care Fraud Statute

The Criminal Health Care Fraud

Statute (18 U.S.C. Section 1347) prohibits

knowingly and willfully executing, or attempting to execute, a scheme or lie

about the delivery of, or payment for, health care benefits, items, or services

to either:

· Defraud any health

care benefit program

· Get (by means of

false or fraudulent pretenses, representations, or promises) the money or

property owned by, or under the custody or control of, a health care benefit program

Penalties for violating the Criminal

Health Care Fraud Statute may include fines, prison, or both.

Now, let’s

review Medicare fraud & abuse penalties for violating the FCA, AKS, Stark

Law, or the Criminal Fraud Statute.

Example: Several doctors

and medical clinics conspired to defraud the Medicare Program by submitting

claims for medically unnecessary power wheelchairs.

5.9 Medicare Fraud & Abuse Penalties

Notes:

Medicare Fraud & Abuse Penalties

Beyond paying restitution to CMS for

money acquired fraudulently, Medicare fraud & abuse penalties may include

exclusions, CMPs, and sometimes criminal sanctions-including fines and

prison-against health care providers and suppliers who violate the FCA, AKS, Physician

Self-Referral Law (Stark Law), or Criminal Health Care Fraud Statute.

Now, let’s

look at Medicare Program exclusions and how they affect providers.

5.10 Exclusion Statute

Notes:

Exclusion Statute

The Exclusion Statute (42 U.S.C. Section 1320a-7) requires the U.S. Department of Health

& Human Services (HHS) Office of Inspector General (OIG) to exclude health

care providers and suppliers convicted of certain offenses from participating

in Federal health care programs. OIG may also impose permissive exclusions on

several other grounds.

Visit the OIG Exclusions Program webpage for more information.

5.11 Exclusion Statute: Referrals

Notes:

Exclusion Statute: Referrals

Excluded providers may not

participate in Federal health care programs for a designated period but may

refer a patient to a non-excluded provider if the excluded provider does not

furnish, order, or prescribe services for the referred patient. In this case,

the non-excluded provider must treat the patient and independently bill Federal

health care programs for items or services provided. Covered items or services

from a non-excluded provider to a Federal health care

program beneficiary are payable, even when an excluded provider referred the

patient.

5.12 Mandatory Exclusion

Notes:

Mandatory Exclusion

For certain offenses, the OIG must

impose an exclusion. Mandatory exclusions stay in effect for a minimum of 5

years; however, aggravating factors may lead to an even longer or permanent

exclusion. Providers and suppliers face mandatory exclusions if convicted of

these offenses:

Mandatory Exclusion Offense

· Medicare or Medicaid

fraud and criminal offenses related to the delivery of items or services under

a Federal or State health care program

· Criminal offenses

related to patient abuse or neglect

· Felony convictions

for other health care-related fraud, theft, embezzlement, breach of fiduciary

responsibility, or other financial misconduct connected to the delivery of a

health care item or service

· Felony convictions

for unlawful manufacture, distribution, prescription, or dispensing controlled substances

5.13 Permissive Exclusion

Notes:

Permissive Exclusion

The OIG may impose exclusions for

offenses not under a mandatory exclusion. Permissive exclusions vary in length.

The OIG may issue permissive

exclusions for various actions.

For a complete list of permissive

exclusions, review 42 U.S.C. Section 1320a-7.

Permissive Exclusion Examples

· Misdemeanor health

care fraud convictions other than Medicare or Medicaid fraud

· Misdemeanor

convictions for unlawfully manufacturing, distributing, prescribing, or

dispensing controlled substances

· Revocation,

suspension, or health care license surrender for reasons of professional

competence, professional performance, or financial integrity

· Providing unnecessary

or substandard service

· Convictions for

obstructing an investigation or audit

· Engaging in

unlawful kickback arrangements

· Defaulting on

health education loan or scholarship obligations

5.14 OIG List of Excluded Individuals/Entities

Notes:

OIG List of Excluded

Individuals/Entities

The OIG List of Excluded

Individuals/Entities (LEIE) publicly lists individuals and entities currently

excluded from participation in all Federal health care programs. Providers and

contracting entities must check the program exclusion status of individuals and

entities in the LEIE before entering employment or contractual relationships.

Health care providers that knowingly

hire an excluded party are subject to potential FCA liability and CMPs.

Medicare will not pay for services by an excluded party, with certain exceptions.

Prior to hiring an individual, purchasing supplies, or contracting with an

entity (and periodically thereafter), health care providers should use the OIG

LEIE to check program exclusion status.

5.15 Search the List of Excluded Individuals/Entities

Notes:

Search the List of Excluded

Individuals/Entities

The LEIE is accessible through a

searchable online database. It identifies parties excluded from Medicare

reimbursement. The list includes information about the provider’s

specialty, exclusion type, and

exclusion date.

Access the LEIE

on the OIG website.

5.16 General Services Administration’s System for Award Management

Notes:

General Services

Administration’s System for Award Management

The General Services Administration

(GSA) consolidated several Federal procurement systems into one new system-the System for Award Management (SAM). SAM incorporated the Excluded Parties

List System (EPLS) and includes information on entities:

· Debarred or

proposed for debarment

· Disqualified from

certain types of Federal financial and non-financial assistance and benefits

· Disqualified from

getting Federal contracts or certain subcontracts

· Excluded

· Suspended

OIG compliance guidance encourages

health care providers to check the SAM prior to hiring an individual,

purchasing durable medical equipment (DME), supplies, or contracting with an

entity (and periodically thereafter). Read the GSA fact sheet How do I search for an exclusion? for detailed instructions.

Remember, health care providers

should check the LEIE and the SAM before making employment and contract

decisions. You cannot get Federal payment or compensation for services provided

by individuals and organizations listed on the LEIE and the SAM.

Now, let’s

look closer at the exclusion payment denial.

5.17 Exclusion: Denial of Payment

Notes:

Exclusion: Denial of Payment

An OIG exclusion means Federal

health care programs do not pay for items or services given, ordered, or

prescribed by an excluded individual or entity. Federal health care programs

also make no payment to the excluded individual, anyone who employs or contracts

with the excluded individual, and a hospital or other provider where the

excluded individual provides services.

The exclusion applies regardless of

who submits the claims for payment and applies to all administrative and

management services given by the excluded individual.

For example, Federal health care

programs do not make payment if:

· A hospital employs

an excluded nurse who provides items or services to Federal health care program

beneficiaries, even

if the nurse’s services are not separately billed and are paid as part of

a Medicare diagnosis-related group payment the hospital gets

· The excluded nurse

violates their exclusion thereby causing the hospital to submit claims for

items or services they provide

During an exclusion period, the excluded

individual or entity may face additional penalties for submitting or causing

the submission of claims to a Federal health care program. The excluded individual

or entity is susceptible to CMP liability as well as reinstatement denial to

the Federal health care programs, including Medicare. Exceptions to payment

denial apply in specific situations.

5.18 Exclusion: Denial of Payment Exceptions

Notes:

Exclusion: Denial of Payment

Exceptions

If a beneficiary submits claims for

items or services given, ordered, or prescribed by an excluded individual or

entity in any capacity after the effective date of the exclusion:

· Medicare pays the

first claim submitted by the beneficiary and immediately gives the beneficiary

notice of the exclusion

· Medicare makes no

payment for the beneficiary items or services given more than 15 days after the

date of the notice or after the effective date of the exclusion, whichever is later

The same process applies when labs

or DME suppliers submit item or service claims ordered or prescribed by an

excluded individual or entity.

There are also exceptions for

certain inpatient hospital, skilled nursing facility, home health, and emergency

services detailed in the Medicare Program Integrity

Manual, Chapter 4,

Section 4.19.2.6.

5.19 Exclusion: Reinstatement

Notes:

Exclusion: Reinstatement

Reinstating excluded entities and

individuals is not automatic once the specified exclusion period ends. Those

who want to participate in all Federal health care programs must apply for

reinstatement and get authorized notice from the OIG they granted reinstatement.

If the OIG denies reinstatement, the excluded party is eligible to re-apply

after 1 year.

Now, let’s

look at CMPs.

5.20 Civil Monetary Penalties

Notes:

Civil Monetary Penalties

CMPs apply to a variety of health

care fraud violations, and assessment of the CMP depends on the type of

violation. The CMP authorizes penalties up to $100,000 (in 2018) per violation,

and assessments of up to 3 times the amount claimed for each item or service,

or up to 3 times the amount of remuneration offered, paid, solicited, or

received. Violations that justify CMPs include:

· Presenting a claim

you know, or should know, is for an item or service not provided as claimed or

is false and fraudulent

· Violating the AKS

· Making false

statements or misrepresentations on applications or contracts to participate in

the Federal health care programs

CMP Inflation Adjustment

Each year, the Federal government

adjusts all CMPs for inflation. The adjusted amounts apply to civil penalties

assessed after August 1, 2016, and violations after November 2, 2015. Refer to 45 CFR 102.3

for the yearly inflation adjustments.

Now, let’s

look at civil prosecutions and penalties.

5.21 Civil Prosecutions and Penalties

Notes:

Civil Prosecutions and Penalties

Depending on the severity of the

violation, a civil suit or settlement may include any combination of the

following:

· A CMP for each item

or service in non-compliance (or higher amounts where applicable by statute)

· Payment up to 3

times the amount claimed for each item or service instead of damages sustained

by the Federal government

· Exclusion from all

Federal health care programs for a specified period

· An OIG Corporate

Integrity Agreement (CIA), which requires an individual or entity to carry out

a compliance program (including, for example, hiring a compliance officer,

developing written standards and policies, carrying out an employee training

program, and conducting annual audits and reviews)

In addition to civil prosecutions

and penalties, law enforcement may prosecute health care fraud and pursue

criminal convictions. Under the Affordable Care Act, the U.S. Sentencing

Commission may add offense levels for health care fraud crimes with more than

$1 million in losses. It is also a crime to obstruct fraud investigations.

Stay updated on the latest

enforcement actions on the OIG Criminal and Civil

Enforcement

webpage.

5.22 Lesson 2: Summary

Notes:

Lesson 2: Summary

· The FCA, AKS,

Physician Self-Referral Law (Stark Law), Criminal Health Care Fraud Statute,

the Social Security Act which includes, the Exclusion Statute, and the CMPLs,

are the main Federal laws that address Medicare fraud & abuse.

· FCA: The FCA

imposes civil liability on a person who knowingly submits, or causes the

submission of, a false or fraudulent claim to the Federal government. The

“knowing” standard includes acting in deliberate ignorance or

reckless disregard of the truth related to the claim.

· Anti-Kickback

Statute: The AKS prohibits knowingly and willfully offering, paying,

soliciting, or getting remuneration in exchange for Federal health care program

business referrals.

· Physician

Self-Referral Law (Stark Law): The Physician Self-Referral Law (Stark Law)

prohibits physicians from referring Medicare beneficiaries for designated

health services to an entity where the physician (or an immediate family

member) has an ownership/investment interest or a compensation arrangement, unless an exception applies.

· Criminal Health

Care Fraud Statute: The Criminal Health Care Fraud Statute prohibits knowingly

and willfully executing, or attempting to execute, a scheme or lie for

delivering, or paying for, health care benefits, items, or services to defraud

a health care benefit program, or to get (by means of false or fraudulent

pretenses, representations, or promises) the money or property owned by, or

under the custody or control of, a health care benefit program.

· Exclusion Statute:

The Exclusion Statute prohibits the excluded individual or entity from

participating in all Federal health care programs. The exclusion means no

Federal health care program pays for items or services given, ordered, or

prescribed by an excluded individual or entity.

· Civil Monetary

Penalties (CMPs): CMPs apply to a variety of conduct violations,

and assessing the CMP amount depends on the violation. Penalties up to

$100,000 (in 2018) per violation may apply. CMPs may also include an assessment

of up to 3 times the amount claimed for each item or service, or up to 3 times

the amount offered, paid, solicited, or got.

· Providers and

contracting entities must check for program exclusion status prior to entering

employment or contractual relationships using the OIG LEIE. OIG recommends

checking SAM as well.

· Civil and criminal

prosecutions can result in a variety of fines, exclusion, CIAs, and even prison

in criminal cases.

5.23 Lesson 2 Review Title Card

Notes:

Review Questions

Lesson 2: Medicare Fraud & Abuse

Laws and Penalties

After selecting an answer for a

question, select Submit Answer for feedback on the correct answer.

5.24 Review Question 1

Notes:

Review Question 1

Select the correct answer.

The Federal fraud & abuse laws

are the False Claims Act (FCA), the Anti-Kickback Statute, the Physician

Self-Referral Law (Stark Law), Criminal Health Care Fraud Statute, Social

Security Act, and the Civil Monetary Penalties Law (CMPL).

· True

· False

5.25 Review Question 2

Notes:

Review Question 2

Select the correct answer.

Which of the following is NOT a

possible penalty for Medicare fraud or abuse?

· A. Exclusion from

participating in all Federal health care programs

· B. Imprisonment in

criminal cases

· C. Civil Monetary

Penalties (CMPs) up to $500,000 per violation

5.26 Completed Lesson 2

Notes:

You’ve completed Lesson

2: Medicare Fraud & Abuse Laws and Penalties

Now that you’ve

learned about Medicare fraud & abuse basic laws and penalties, let’s

look at preventing Medicare fraud & abuse.

Select the Continue Arrow to return

to the Course Menu. Then, select Lesson 3: Physician Relationships with Payers,

Other Provider, and Vendors.

6. Lesson 3

6.1 Lesson 3 Title Card

Notes:

Medicare Fraud & Abuse: Prevent,

Detect, Report

Lesson 3: Physician Relationships

with Payers, Other Providers, and Vendors

6.2 Lesson 3: Introduction

Notes:

Lesson 3: Physician Relationships

with Payers, Other Providers, and Vendors

In this lesson, you’ll

learn how physician relationships with payers, other providers, and vendors can

prevent Medicare fraud & abuse. It should take about 15 minutes to

complete.

In this lesson, you’ll

learn about:

· How you can help

prevent Medicare fraud & abuse

· How compliance with

Medicare laws, regulations, and policies prevent fraud & abuse

· Continuing

education available on Medicare laws, regulations, and polices about fraud

& abuse prevention

6.3 Lesson 3: Learning Objectives

Notes:

Lesson 3: Learning Objectives

After completing this lesson, you

should correctly:

· Identify ways your

relationships with payers, other providers, and vendors prevent fraud & abuse

· Identify ways to

comply with Medicare laws, regulations, and policies to prevent fraud & abuse

· Identify continuing

education available on Medicare laws, regulations, and policies

6.4 Physician Relationships with Payers, Other Providers, and Vendors

Notes:

Physician Relationships with Payers,

Other Providers, and Vendors

The U.S. health care system relies

on third party payers to pay most medical bills on behalf of patients. These

payers understand Federal fraud & abuse laws apply when the government

covers items or services provided to Medicare and Medicaid beneficiaries. This

lesson focuses on:

· Physician

Relationships with Payers

· Physician

Relationships with Other Providers

· Physician

Relationships with Vendors

· Continuing Medical

Education on Medicare laws, regulations, and policies

6.5 You Can Help Prevent Medicare Fraud & Abuse

Notes:

You Can Help Prevent Medicare Fraud

& Abuse

As a health care provider, you play

a vital role in the fight against Medicare fraud & abuse. Help prevent

Medicare fraud &

abuse by:

· Checking the List

of Excluded Individuals/Entities (LEIE) and System for Award Management (SAM)

before making hiring and contracting decisions

· Providing only

medically necessary, high quality Medicare beneficiary services

· Accurately coding

and billing Medicare services

· Maintaining

accurate and complete Medicare beneficiary medical records

· Understanding and

complying with the Anti-Kickback Statute and Physician Self-Referral Law (Stark

Law) when making investments or doing business with vendors

·

6.6 You Can Help Prevent Medicare Fraud & Abuse (continued)

Notes:

You Can Help Prevent Medicare Fraud

& Abuse (continued)

Fraud & abuse also exist in

Medicare Part C, Part D, and Medicaid, especially involving “dual eligibles.”

For more information, see Job Aid

C and Job Aid D.

Now let’s

look at physicians’ relationships with payers related to accurate coding,

billing, documentation, investments, and physician recruitment.

6.7 Accurate Coding and Billing

Notes:

Accurate Coding and Billing

As a physician, payers trust you to

provide medically necessary, cost-effective, quality care. When you submit

claims for Medicare services, you certify you earned the payment and complied

with billing requirements. If you knew, or should have known, you submitted a

false claim, this is an illegal attempt to collect payment. Examples of

improper claims include:

Examples of improper claims include:

· Billing

codes that reflect a more severe illness than existed or a more expensive

treatment than provided

· Billing

medically unnecessary services

· Billing

services not provided

· Billing

services performed by an improperly supervised or unqualified employee

· Billing

services performed by an employee excluded from participation in Federal health

care programs

· Billing

services of such low quality they are virtually worthless

· Billing

separately for services already included in a global fee, like billing an

Evaluation and Management (E/M) service the day after surgery

6.8 Physician Documentation

Notes:

Physician Documentation

Maintain accurate and complete

records of the services you provide. Make sure your documentation supports your

claims for payment. Good documentation practices help ensure your patients get

appropriate care and allow other providers to rely on your records for

patients’ medical histories.

The Medicare Program may review

beneficiaries’ medical records. Good documentation helps address any

challenges raised about the integrity of your claims. You may have heard the

saying regarding malpractice litigation: “If you didn’t document

it, it’s the same as if you didn’t do it.” The same can be

said for Medicare billing.

6.9 Physician Documentation (continued)

Notes:

Physician Documentation (continued)

Medicare pays for many physician

services using E/M codes. These codes identify the level of service and

pay new patient codes at a higher level than established patients. Billing an

established patient follow-up visit using a higher-level E/M code is upcoding.

Another example of E/M upcoding is

misusing modifier -25, which allows additional payment for a significant,

separately identifiable E/M service provided on the same day of a procedure or

other service. Upcoding occurs when a provider uses modifier -25 to claim

payment for a medically unnecessary E/M service, an E/M service not distinctly

separate from the procedure provided, or an E/M service not above and beyond

the care usually associated with the procedure.

CPT only copyright 2018 American

Medical Association. All rights reserved.

6.10 Physician Investments in Health Care Business Ventures

Notes:

Physician Investments in Health Care

Business Ventures

Some physicians who invest in

business ventures with outside parties (for instance, imaging centers, laboratories,

equipment vendors, or physical therapy clinics) refer more patients for

services provided by those parties than physicians who do not invest. These

business relationships may improperly influence or distort physician

decision-making and result in improper patient-steering to a therapy or service

where a physician has a financial interest.

Excessive and medically unnecessary

referrals waste Federal government resources and can expose Medicare

beneficiaries to harmful, unnecessary services. Many of these investment

relationships have legal risks under the AKS and Stark Law.

If a health care business invites

you to invest and might be a place where you would refer your patient,

investigate the relationship thoroughly before proceeding.

6.11 Physician Recruitment

Notes:

Physician Recruitment

Hospitals and other health systems

may provide a physician-recruitment incentive to induce providers or practices

to join their medical staff. Often, such recruitment efforts fill a legitimate

“clinical gap” in a medically underserved area where attracting

physicians may be difficult without financial incentives.

Some hospitals, however, may offer

incentives which cross the line into an illegal arrangement with legal

consequences for the provider and the hospital.

A hospital may pay a provider a fair

market-value salary as an employee or pay them a fair market value for specific

services they provide to the hospital as an independent contractor. The

hospital may not offer money, free or below-market rent for a medical office, or engage in similar activities designed to

influence referral decisions.

Now let’s

look at physician relationships with vendors related to transparency and

conflict of interest.

6.12 Physician Relationships with Vendors

Notes:

Physician Relationships with Vendors

Many drug

and biologic companies provide free product samples to physicians. It is legal

to give these samples to patients free of charge, but it is illegal to sell the

samples. The Federal government prosecutes physicians for billing Medicare for

free samples. Implement reliable systems to safely store free samples and

ensure they remain separate from your commercial stock.

Some pharmaceutical and device

companies use sham consulting agreements and other arrangements to buy physician

loyalty. If you have opportunities to work as a consultant for the drug or

device industry, evaluate the link between the services you provide and the

compensation you get. Test the appropriateness of any proposed relationship by

asking yourself:

· Does the company

really need your specific expertise or input?

· Does the

company’s monetary compensation represent a fair, appropriate, and

commercially reasonable exchange for

your services?

· Is it possible the

company is paying for your loyalty, so you prescribe or use its products?

6.13 Federal Open Payments Program

Notes:

Federal Open Payments Program

The Federal Open Payments Program is

a national disclosure program that promotes health care transparency by making

financial relationships between health care providers and drug and medical

device companies available to the public. The Open Payments data includes

payments and other transfers of value such as gifts, honoraria, consulting

fees, research grants, travel reimbursements, and other payments drug or device

companies provide to physicians and teaching hospitals. The data also includes

ownership and investment interests held by physicians or their immediate family

members in reporting entities.

Data from a given year must be

reported by drug and device companies by March 31 of the following year. CMS

posts Open Payments data on or by June 30 each year. The public data is

accessible via the Open Payments Search Tool. CMS closely

monitors this process to ensure reported data integrity.

Visit Open Payments

for more information.

6.14 Conflict-of-Interest Disclosures

Notes:

Conflict-of-Interest Disclosures

Rules about disclosing and managing

conflicts of interest come from a variety of sources, including grant funders,

such as States, universities, and the National Institutes of Health (NIH), and

from the U.S. Food and Drug Administration (FDA) when you submit data to

support marketing approval for new drugs, devices, or biologics.

If you are uncertain whether a

conflict exists, ask yourself if you would want the arrangement to appear in

the news.

6.15 Education on Medicare Laws, Regulations, and Policies

Notes:

Education on Medicare Laws,

Regulations, and Policies

The Medicare Learning Network®

(MLN) offers a variety of health care training and educational materials

explaining Medicare policy. The MLN delivers planned and coordinated provider

education through various media, including MLN Matters® Articles, fact

sheets and booklets, web-based training courses, videos, and podcasts. Visit

the MLN for a list of educational products.

The MLN Provider Compliance webpage contains educational products

informing Medicare Fee-For-Service (FFS) Providers how to avoid common Medicare

Program billing errors and other improper activities.

The OIG Compliance

webpage provides education, compliance guidance, advisory opinions, and

training resources.

Medicare Administrative Contractor (MAC)

Provider Outreach and Education (POE) Programs offer providers and suppliers

education on the fundamentals of the Medicare Program.

6.16 Lesson 3: Summary

Notes:

Lesson 3: Summary

You play a vital role in detecting

fraud. Your actions can help protect the Medicare Trust Fund. Be sure to

review:

· Your relationships

with payers related to accurate coding, billing, and documentation

· Your relationships

with other providers related to investments and recruitment

· Your relationships

with vendors related to transparency and conflict of interest

· Training available

related to Medicare laws, regulations, and policies

6.17 Lesson 3 Review Title Card

6.18 Review Question 1

Notes:

Review Question 1

Select the correct answer.

You can help prevent Medicare fraud

& abuse by __________.

· A. Providing only

medically necessary, high quality services to Medicare beneficiaries

· B. Properly

documenting all services provided to Medicare beneficiaries

· C. Correctly

billing and coding services provided to Medicare beneficiaries

· D. All of the above

6.19 Review Question

Notes:

Review Question 2

Select the correct answer.

The Medicare Learning Network®

provides a variety of __________ for health care professionals.

· A. Coding Rules

· B. Training and

educational products

· C. Regulations

· D. Enrollment forms

6.20 You’ve completed Lesson 3: Physician Relationships with Payers, Other Providers, and Vendors

Notes:

You’ve completed Lesson

3: Physician Relationships with Payers, Other Providers, and Vendors

Now that you’ve

learned how your relationships with payers, other providers, and vendors

prevent fraud & abuse, let’s look at Medicare anti-fraud partnerships

and agencies.

Select Continue Arrow to return to

the Main Menu. Then, select Lesson 4: Medicare Anti-Fraud and Abuse

Partnerships

and Agencies.

7. Lesson 4

7.1 Lesson 4 Title Card

Notes:

Medicare Fraud & Abuse: Prevent,

Detect, Report

Lesson 4: Medicare Anti-Fraud and

Abuse Partnerships and Agencies

7.2 Lesson 4: Review

Notes:

Lesson 4: Medicare Anti-Fraud and

Abuse Partnerships and Agencies

In this lesson, you’ll

learn about the entities and methods used to detect fraud & abuse. It

should take about 15 minutes to complete this lesson.

In this lesson, you will learn

about:

· Efforts by the

Centers for Medicare & Medicaid Services (CMS) to detect fraud & abuse

in the Medicare program

· Data analysis, the

Fraud Prevention System (FPS), and the Integrated Data Repository (IDR)

· Entities that

conduct pre-payment and/or post-payment claims review to detect Medicare fraud

& abuse

· Entities that

investigate suspected Medicare fraud & abuse

The return on investment from

2016-2018 was $4.00 for every $1.00 dollar spent on fighting health care fraud

& abuse.

7.3 Lesson 4: Learning Objectives

Notes:

Lesson 4: Learning Objectives

After completing this lesson, you

should correctly:

· Recognize efforts

by CMS to detect fraud & abuse in the Medicare program

· Recognize entities

conducting pre-payment and/or post-payment claims review

· Recognize entities

investigating suspected Medicare fraud & abuse

7.4 Health Care Fraud Prevention Partnership

Notes:

Health Care Fraud Prevention

Partnership

The Health Care Fraud Prevention Partnership (HFPP) is a

voluntary, public-private partnership including 132 partners from the Federal

government, state agencies, law enforcement, private health insurance plans,

employer organizations, and health care anti-fraud associations. Their goal is

to identify and reduce fraud, waste, and abuse across the health care sector

through collaboration, data and information sharing, and cross-payer research

studies. The HFPP also performs sophisticated industry-wide analytics to detect

and predict fraud schemes.

7.5 The Centers for Medicare & Medicaid Services

Notes:

The Centers for Medicare &

Medicaid Services

CMS is the Federal

agency within the Department of Health and Human Services (HHS) that

administers the Medicare and Medicaid programs.

· Accreditation

Organizations

· Medicare

beneficiaries and caregivers

· Physicians,

suppliers, and other health care providers

· Office of

Inspector General (OIG)

· Federal

Bureau of Investigation (FBI)

· Contractors

Let’s review the

contractors that assist with CMS efforts to prevent and detect fraud.

7.6 Claim-Reviewing Entities

Notes:

Claim-Reviewing Entities

CMS authorizes several different

contractors to conduct pre-payment and/or post-payment reviews of claims. These

include:

· Comprehensive

Error Rate Testing (CERT) Contractors

· Medicare

Administrative Contractors (MACs)

· Recovery

Audit Contractors (RACs)

· Supplemental

Medical Review Contractor (SMRC)

· Unified

Program Integrity Contractors (UPICs)

If one of these entities contacts

you, respond within the specified timeframe and with all requested

documentation supporting the claim service(s) medical necessity. This ensures

accurate payment of the claim(s) under review and prevents payment recoupment

for claims correctly paid. Contact your MAC <http://go.cms.gov/MAC-website-list>

to find contact information for your review contractors.

7.7 Comprehensive Error Rate Testing Program

Notes:

Comprehensive Error Rate Testing

Program

The CERT Program

produces a national Medicare Fee-For-Service (FFS) error rate. CERT randomly

selects a statistically valid, random sample of Medicare FFS claims and reviews

those claims’ and related medical records’

compliance with Medicare coverage, payment, coding, and billing rules.

To accurately measure the

MACs’ performance and gain insight into error causes, CMS calculates a

national Medicare FFS paid claims error rate and an improper payment rate by

claim type and publishes the results of these reviews annually.

For example, here are the improper

payment rate and projected improper payment amounts by claim type for Fiscal

Year (FY) 2018. If you see your provider type on this list, refer to Job Aid D

for tips on avoiding fraud & abuse.

Service Type - Inpatient Hospitals,

Improper Payment Rate - 4.29%, Improper Payment Amount - $4.96B

Service Type - Durable Medical Equipment, Improper

Payment Rate - 35.54%, Improper Payment Amount - 2.59B

Service Type - Physician/Lab/Ambulance,

Improper Payment Rate - 10.68%, Improper Payment Amount - $10.47B

Service Type - Non-Inpatient

Hospital Facilities, Improper Payment Rate - 8.07%, Improper Payment

Amount - $13.60B

Service Type - Overall, Improper

Payment Rate - 8.12%, Improper Payment Amount - $31.62B

7.8 CERT Program FFS Improper Payment Rate

Notes:

CERT Program FFS Improper Payment Rate

The Medicare FFS Improper Payment

Rate is a good indicator of how Medicare FFS claims errors impact the Medicare

Trust Fund. CMS and MACs educate providers and suppliers on CERT-identified

high-risk areas.

For more information, visit the CERT Documentation Contractor website. The CERT Outreach and Education Task Force provides consistent, accurate

provider outreach and education to help reduce the improper payment rate.

7.9 Medicare Administrative Contractors

Notes:

Medicare Administrative Contractors

CMS, MACs, and other claim review

contractors identify suspected billing problems through error rates produced by

the CERT Program, vulnerabilities identified through the Recovery Audit

Program, analysis of claims data, and evaluation of other information (for

example, complaints).

CMS, MACs, and other claim review

contractors target Medical Review (MR) activities on problem areas based on the

severity of the problem. The SMRC conducts nationwide MR as directed by CMS.

This includes identifying underpayments and overpayments.

MR may occur before or after the MAC

makes a payment on the claim. MACs may review one or multiple claims at the

same time.

Some providers may go through probed

reviews or placed on Progressive Corrective Action (PCA) plans depending on the

extent of their billing errors.

7.10 Medicare FFS Recovery Audit Program

Notes:

Medicare FFS Recovery Audit Program

Medicare FFS Recovery Audit

Contractors (RACs) conduct post-payment claim reviews to detect improper

underpayments and overpayments. RACs may target claim reviews by service. Each

RAC website publishes its targeted services. Visit the Recovery Audit Program webpage for more information, including

Medicare Parts A and B Recovery Auditors contact information.

Also review the Quarterly Provider Compliance Newsletter for common

Medicare FFS Recovery Audit and CERT findings and tips for avoiding issues.

7.11 Parts C and D Recovery Audit Program

Notes:

Parts C and D Recovery Audit Program

CMS created the Parts C and D

Recovery Audit Program to identify and correct past improper payments to

Medicare providers. CMS also implemented procedures to help MACs prevent future

improper payments. Communication about audit results and trends leads to continuous

process improvement, more accurate payments, and helps plan sponsors correct

issues in a timely manner.

CMS designated one Recovery Auditor

to review payments for Medicare Part D. CMS will start the Recovery Audit

Program for Medicare Part C payments in the future. Visit the Parts C and D Recovery Audit Program webpage for more information.

Now that you’ve

learned about the entities that review claims, let’s discuss entities

that provide analytical support to CMS to detect fraud & abuse activities.

7.12 Analytical Entities

Notes:

Analytical Entities

Within CMS, the Center for Program Integrity (CPI) promotes Medicare integrity through

audits, policy reviews, and identifying and monitoring program vulnerabilities.

CPI oversees CMS’ collaboration with key stakeholders on detecting,

deterring, monitoring, and combating fraud & abuse issues.

In 2010, HHS and CMS launched the

Fraud Prevention System (FPS), a state of-the-art predictive analytics

technology that runs Medicare FFS claims predictive algorithms and other

analytics prior to payment to detect potentially suspicious claims and patterns

that may constitute fraud & abuse.

7.13 Fraud Prevention System

Notes:

Fraud Prevention System

The FPS uses sophisticated analytics

to prevent and detect fraud & abuse in the Medicare FFS Program. It provides

a comprehensive view of Medicare FFS provider and beneficiary activities to

identify and analyze provider networks, billing patterns, beneficiary usage

patterns, and patterns representing a high risk of fraudulent activity.

The FPS is fully integrated with the

Medicare FFS claims processing system and uses other data sources, such as the

Integrated Data Repository (IDR).

· A home health

agency in Florida billed services never provided. Due to the FPS, CMS placed

the home health agency on pre-payment review and payment suspension, referred

the agency to law enforcement, and ultimately revoked the agency’s Medicare

enrollment.

· In Texas, the FPS

identified an ambulance company submitting claims for non-covered services and

services not given. Medicare revoked the ambulance company’s enrollment.

· The FPS identified

an Arizona medical clinic with questionable billing practices, such as billing

excessive units of service per beneficiary per visit. The physicians delivered

repeated and unnecessary neuropathy treatments to beneficiaries. CMS revoked

the medical clinic’s Medicare enrollment.

7.14 Integrated Data Repository

Notes:

Integrated Data Repository

The IDR creates an integrated data

environment from Medicare and Medicaid claims, beneficiaries, providers,

Medicare Advantage (MA) plans, Part D Prescription Drug Events (PDEs), and

other data.

The IDR provides greater information

sharing, broader and easier access, enhanced data integration, increased security and privacy, and strengthened query and analytic

capability by building a unified data repository for reporting and analytics.

Now let’s

review the entities that help CMS investigate fraud & abuse activities.

7.15 Investigating Entities

Notes:

Investigating Entities

The following entities review claims

and more extensively investigate specific health care providers:

· UPICs

· Office of

Inspector General (OIG)

· Department

of Justice (DOJ)

· Health Care

Fraud Prevention and Enforcement Action Team (HEAT)

· Federal

Bureau of Investigation (FBI)

These entities work with the claim reviewing

entities and CMS to protect the Medicare Program against fraud & abuse.

Medicare Advantage (MA) plans also

investigate Medicare Part C fraud & abuse. Prescription Drug Plans (PDPs)

investigate Medicare Part D fraud & abuse. Medicare Drug Integrity

Contractors (MEDICs) investigate Medicare Part C and Part D fraud & abuse.

7.16 Unified Program Integrity Contractors

Notes:

Unified Program Integrity

Contractors

UPICs identify suspected fraud &

abuse cases and refer them to the OIG. UPICs may also act to minimize potential

losses to the Medicare Trust Fund and protect Medicare beneficiaries from

potential adverse effects. Appropriate action varies from case to case. For

example, when a provider’s employee files a complaint, the UPIC

immediately advises the OIG.

For more information, go to the Medicare Program Integrity Manual, Chapter 4.

7.17 Office of Inspector General

Notes:

Office of Inspector General

The OIG

protects the integrity of HHS programs, including Medicare, and the health and

welfare of its beneficiaries. The OIG carries out its duties through a

nationwide network of audits, investigations, inspections, and other related

functions. The OIG can exclude individuals and entities who engaged in fraud or

abuse from participation in all Federal health care programs and impose Civil

Monetary Penalties (CMPs) for certain Federal health care program misconduct.

7.18 Department of Justice

Notes:

Department of Justice

The DOJ investigates and prosecutes

fraud & abuse in Federal government programs. The DOJ’s investigators

partner with the OIG; the FBI; and other Federal, State, and local law

enforcement offices through HEAT to investigate and prosecute Medicare fraud

& abuse. DOJ attorneys, through the U.S. Attorney’s Offices, handle

the civil and criminal prosecutions.

7.19 Health Care Fraud Prevention and Enforcement Action Team

Notes:

Health Care Fraud Prevention and

Enforcement Action Team

The DOJ and HHS established HEAT to

build and strengthen existing programs to combat Medicare fraud while investing

new resources and technology to prevent fraud & abuse. HEAT investigators

use new state-of-the-art technology to fight fraud with unprecedented speed and

efficiency.

7.20 Medicare Fraud Strike Force

Notes:

Medicare Fraud Strike Force

The DOJ-HHS Medicare Fraud Strike

Force also fights fraud. Each Medicare Fraud Strike Force team combines the

FBI’s investigative and analytical resources with HHS-OIG’s

Criminal Division’s Fraud Section and the U.S. Attorney’s Offices

prosecutorial resources.

Editable content from image:

Strike Force Statistics

Since Inception

· Cases

Filed: 1,750

· Defendants

Charged: 3,800

· Defendants

Billed Medicare: $15 billion

7.21 Lesson 4: Summary

Notes:

Lesson 4: Summary

· Medicare fraud &

abuse data helps guide claims reviewers and investigators to high-risk fraud

& abuse areas.

· MACs and UPICs

conduct pre-payment claims reviews.

· MACs, the SMRC,

UPICs, CERT Contractors, and RAC Auditors conduct post-payment claims reviews.

· UPICs, OIG, DOJ,

and HEAT investigate Medicare fraud & abuse.

7.22 Lesson 4 Review Title Card

Notes:

Review Questions

Lesson 4: Medicare Anti-Fraud and

Abuse Partnerships and Agencies

After selecting an answer for a

question, select Submit Answer for feedback on the correct answer.

7.23 Review Question 1

Notes:

Review Question 1

Select the correct answer.

You can help prevent Medicare fraud

& abuse by __________.

· A. Medicare

Administrative Contractors (MACs)

· B. Comprehensive

Error Rate Testing (CERT) Contractors

· C. Recovery Audit

Program Recovery Auditors

· D. All of the above

7.24 Review Question 2

Notes:

Review Question 2

Select the correct answer.

Which of the following entities

investigate health care providers suspected of Medicare fraud & abuse?

· A. Office of Inspector

General (OIG)

· B. Department of

Justice (DOJ)

· C. Unified Program

Integrity Contractors (UPICs)

· D. B and C

· E. A, B, and C

7.25 You’ve completed Lesson 4: Medicare Anti-Fraud and Abuse Partnerships and Agencies

Notes:

You’ve completed Lesson

4: Medicare Anti-Fraud and Abuse Partnerships and Agencies

Now that you’ve

learned about the basic concepts of Medicare fraud & abuse detection,

let’s look at how to report Medicare fraud & abuse.

Select the Continue Arrow to return

to the Course Menu. Then, select Lesson 5: Report Suspected Medicare Fraud

& Abuse.

8. Lesson 5

8.1 Lesson 5 Title Card

Notes:

Medicare Fraud & Abuse: Prevent,

Detect, Report

Lesson 5: Report Suspected Medicare

Fraud & Abuse

8.2 Lesson 5 Review

Notes:

Lesson 5: Report Suspected Medicare

Fraud & Abuse

In this lesson, you’ll

learn about reporting fraud & abuse. It should take about 5 minutes to

complete.

In this lesson, you’ll

learn about:

· How you can report

suspected Medicare fraud & abuse

· How you can

self-disclose Medicare fraud & abuse

· The Medicare

Incentive Reward Program (IRP)

8.3 Lesson 5: Learning Objectives

Notes:

Lesson 5: Learning Objectives

After completing this lesson, you

should correctly:

· Recognize how to

report suspected Medicare fraud & abuse

· Recognize how to self-disclose

Medicare fraud & abuse

8.4 How to Report Suspected Medicare Fraud & Abuse: OIG

Notes:

How to Report Suspected Medicare

Fraud & Abuse: OIG

The Office of Inspector General

(OIG) maintains a hotline and webpage that accepts and reviews tips from all

sources, such as Medicare and Medicaid beneficiaries and providers. You can

report suspected fraud & abuse anonymously by phone (OIG Hotline), email,

fax, mail, and on the OIG website. The OIG collects no information that could

trace the complaint to you; however, lack of contact information may prevent a

comprehensive review of the complaint. OIG encourages you to provide contact

information for follow-up.

Use Job Aid E

to report fraud & abuse to the appropriate authorities.

8.5 How to Report Suspected Medicare Fraud & Abuse: MAC

Notes:

How to Report Suspected Medicare

Fraud & Abuse: MAC

For questions about Medicare billing

procedures, billing errors, or questionable billing practices, contact your Medicare Administrative Contractor (MAC).

8.6 What to do if you Suspect you have Problematic Relationships or Inappropriate Billing Practices:

Notes:

What to do if you Suspect you have

Problematic Relationships or Inappropriate Billing Practices:

· Stop submitting

problematic bills

· Seek legal counsel

· Determine money

collected in error from patients and from Federal health care programs and

report and return refunds

· Cease involvement

in a problematic investment

· Get out of the

problematic relationship(s)

· Consider

self-disclosing the issues

8.7 How to Self-Disclose Medicare Fraud & Abuse to the OIG

Notes:

How to Self-Disclose Medicare Fraud

& Abuse to the OIG

Providers who wish to voluntarily

disclose evidence of potential fraud, where it may trigger Civil Monetary

Penalties (CMPs), may do so under the OIG Provider Self-Disclosure Protocol

(SDP). Self-disclosure gives providers the opportunity to minimize the costs

and disruptions associated with a government-directed investigation and civil

or administrative litigation.

The OIG works cooperatively with forthcoming,

thorough, and transparent providers in their disclosures to resolve these

matters. While the OIG does not speak for the Department of Justice (DOJ) or

other agencies, the OIG consults with these agencies, as appropriate, regarding

SDP issues resolution.

Visit the OIG Self-Disclosure Information webpage for more information or to

complete your self-disclosure online.

8.8 How to Self-Disclose Actual or Potential Violations of the

Physician Self-Referral Law (Stark Law)

Notes:

How to Self-Disclose Actual or

Potential Violations of the Physician Self-Referral Law (Stark Law)

For Physician Self-Referral Law

(Stark Law) actual or potential violations, Centers for Medicare & Medicaid

Services (CMS)

Self-Referral Disclosure Protocol (SRDP) allows health

care providers and suppliers to self-disclose them through a separate

OIG process.

The physician cannot use the SRDP to

get a CMS determination as to whether an actual or potential violation of the

Physician Self-Referral Law (Stark Law) occurred. Providers and suppliers

should submit their overpayment liability exposure to the SRDP to resolve the

conduct they identify.

Under certain circumstances, CMS can

reduce the amount due. However, fraud & abuse self-disclosure does not

protect health care providers from sanctions and prosecutions.

8.9 Medicare Incentive Reward Program

Notes:

Medicare Incentive Reward Program

CMS established the Medicare IRP to

encourage reporting suspected fraud & abuse.

The IRP rewards information on

Medicare fraud & abuse or other punishable activities. The information must

lead to a minimum Medicare recovery of $100 from individuals and entities CMS

determines committed fraud.

For more information, go to the Medicare Program Integrity Manual, Chapter 4, Section 4.9.

8.10 Lesson 5: Summary

Notes:

Lesson 5: Summary

· You may report

suspected Medicare fraud & abuse by phone, email, fax, mail, and on the OIG

website.

· You may

self-disclose fraud & abuse to the OIG using the Provider SDP. You may

self-disclose actual or potential violations of the Physician Self-Referral Law

(Stark Law) to CMS using the Medicare SRDP.

· The Medicare IRP

provides rewards for Medicare fraud & abuse information or other punishable

activities.

8.11 Lesson 5 Review Title Card

Notes:

Review Questions

Lesson 5: Report Suspected Medicare

Fraud & Abuse

After selecting an answer for a

question, select Submit Answer for feedback on the correct answer.

8.12 You may report suspected fraud & abuse anonymously by phone, email, fax, mail, and on the Office of Inspector General (OIG) website.

Notes:

Review Question 1

Select the correct answer.

You may report suspected fraud &

abuse anonymously by phone, email, fax, mail, and on the Office of Inspector

General (OIG) website.

· True

· False

8.13 Health care providers who self-disclose fraud & abuse violations are protected from sanctions and prosecutions.

Notes:

Review Question 2

Select the correct answer.

Health care providers who

self-disclose fraud & abuse violations are protected from sanctions and

prosecutions.

· True

· False

8.14 You’ve completed Lesson 5: Report Suspected Medicare Fraud & Abuse.

Notes:

You’ve completed Lesson

5: Report Suspected Medicare Fraud & Abuse.

Now that you’ve

learned about Medicare fraud & abuse prevention, detection, and reporting,

let’s take an assessment to see how much you’ve learned.

Select the Continue Arrow to return

to the Course Menu. Then, select Assessment.

9. Assessment

9.1 Assessment Title Card

Notes:

Assessment

9.2 Lesson 5 Review

Notes:

Assessment

Let’s see how much

you’ve learned. This assessment asks you 10 Medicare Fraud & Abuse:

Prevent, Detect, Report questions. Your estimated completion time is 15

minutes.

You can change your answer until you

select Submit Answer. Once you select Submit Answer, you can’t

change your answer. After selecting Submit Answer and reviewing the answer

feedback, select Next to continue. Once you select Next, you can’t

exit and save your progress.

After successfully completing the

course, you’ll get instructions on how to get a

certificate. Successfully completing the course includes completing all lessons

and a passing assessment grade of at least 70%.

Select Next to begin the assessment.

9.3 Assessment Question 1 of 10

(Multiple Choice, 10 points, 1 attempt

permitted)

Notes:

Question 1 of 10

Select the correct answer.

The Federal laws that address fraud

& abuse include __________.

· A. False Claims Act

(FCA)

· B. Anti-Kickback

Statute

· C. Physician

Self-Referral Law (Stark Law)